Blog: Internet of Things: Everything to Know

Here is all you need to know about IoT:

- What does IoT stand for?

- What is the Internet of Things (IoT)?

- How does IoT work?

- Why does IoT matter?

- Fun Facts about IoT

- Benefits of the Internet of Things

- What are Two Major Concerns Regarding IoT Devices?

- Internet of Things Companies

- The Future of IoT

- Why IoT Requires Integration

What does IoT stand for?

IoT stands for the Internet of Things.

What is the Internet of Things (IoT)?

Simply put, the Internet of Things is a system of interconnected physical devices that communicate via the Internet. These Internet of Things devices collect and share data with other devices, applications, and systems, and in many ways the data “talks” to us and the other things it’s connected to.

From wearables to industrial sensors, IoT devices generate sensory, biotelemetry, and a myriad of other types of data.

How does IoT work?

IoT is a system of Internet-connected devices. These devices are essentially mini-computer processors that use machine learning to act on data collected by sensors. IoT devices can range from smart warehouse vehicles to fitness trackers to cold storage temperature monitors.

A complete IoT system integrates 4 parts:

1. Sensors/devices

Smart devices or sensors pass data to the cloud.

2. Data Collection and Connectivity

Data is passed from a device or sensor to the cloud via some type of connection. How these devices connect varies and depends on the purpose of the device.

The common methods today include:

- HTTP/S

- Bluetooth

- RFID readers

- FTP

And a host of new communications protocols specific to IoT.

Through one of the methods listed above, data is passed to a gathering point at a data center or within the cloud.

3. Data Processing and/or Machine Learning

After the IoT device collects data from its surroundings data and aggregates the information within a data center or cloud, software processes it. The device can decide to perform an action like sending an alert to a user or automatically adjusting a sensor without user intervention.

As data is assembled, many IoT devices can learn about user preferences and automatically adjust to match those preferences. The combination of data processing and machine learning is what makes some IoT products smart devices.

The fact that IoT devices can learn without programming is incredibly valuable.

Think of the smart thermostat that automatically adjusts itself to the ideal indoor temperature or the smart refrigerator that does not just notify you that you are low on a certain grocery item, but automatically orders a replacement.

4. User Interface

While automation continues to revolutionize how we interact with IoT devices, there are some decisions or actions that need to be enabled by a traditional user interface. A user may want to adjust the temperature of a thermostat using his or her smartphone or check the IoT security camera they have installed in their house using the same phone. If user input or intervention is required, an IoT user interface enables the user to respond accordingly.

Why does IoT matter?

In a nutshell, the Internet of Things is a massive network of connected devices, and that network is growing by the minute. Today, there are more than 50 billion IoT devices deployed. This massive network of devices, in turn, generates and communicates data with other connected devices or systems. The communication of data is key to the value in IoT, allowing consumers or businesses to access raw information, gain insight, and make an intelligent decision based on the story the data tells.

The benefits of IoT are wide-ranging and more and more companies have begun to realize the potential applications for business. There are also risks and downsides, however, revolving around Internet of Things security and standards.

While the majority of IoT devices are currently consumer-based, such as smart TVs, vehicles, wearable exercise monitors, and even refrigerators, businesses are also taking advantage, via security cameras, smart building infrastructure, connected electric meters, industrial control systems, GPS systems, and RFID chips to name a few use cases.

Processors are more affordable than ever, and due to the abundance of wireless networks, it is now possible to connect just about anything, turning it “smart,” and with data-generating sensors, creating a new intersection between the digital and physical worlds.

Fun Facts about IoT

Whatever the Internet of Things (IoT) is today could be much different just weeks from now. And predictions about the size and the impact that IoT will have on business vary greatly. After all, the extent to which IoT is forecast to impact society is constantly changing in scope – usually in terms of how much further that extent is estimated to be.

That’s because IoT has always fluctuated with other technology. IoT grows as the cloud grows; IoT expands as network capabilities expand; IoT scales as data analytic tools scale; and so on.

In the early 2000s, LG released an internet-connected refrigerator that was basically a $20,000 350-pound computer with limited capabilities. Fast-forward through many variations of the IoT refrigerator to 2020, where Samsung’s smart fridge not only tracks stored contents and expiration dates but also connects to an app with voice-recognition to help order new items.

Here are some interesting facts about the internet of things:

1. The global IoT market

2014: $2.99 trillion ⇒ 2020: $8.90 trillion

What it means: Well, the $6 trillion surges speaks for itself: There’s a need for all things IoT. And as the IoT technology in products has improved, so has the demand. Data integration from different cyber, physical, and social means in IoT allows for smarter app and service development.

Source: Statista Worldwide Internet of Things Market

2. The number of connected devices worldwide

2018: 23.14 billion ⇒ 2025: 75.44 billion

What it means: Devices are continually offering better design, implementation, and operation for connected systems and ecosystems. And with services growing and as more apps emerge, costs for devices drop while the production jumps.

Source: IOT Number of Connected Devices Worldwide

3. Global number of RFID tags

2018: 17.6 billion ⇒ 2020: 24.5 billion

What it means: What is RFID? It stands for radio-frequency identification. So, what’s that got to do with IoT? Well, IoT has put these tags at the forefront of the supply chain and logistics industries providing real-time insight into the movement of goods and impacting the efficacy and transparency of global trade. RFID tags are embedded with specific information and attached to objects in order to track location and provide visibility to the transfer of the associated product.

Source: Size of the Global RFID Market

4. Worldwide spending on third party connectivity for IoT

2018: $742.6 million ⇒ 2020: $1.18 billion

What it means: Investors will keep pouring cash into IoT projects, which has not only unlocked opportunities for connected business partners but also calls for all devices to be connected at some point.

Source: 3rd Party IOT Connectivity Revenue

5. Number of M2M connections

2018: 1.5 billion ⇒ 2020: 2.6 billion

What it means: M2M (machine-to-machine) technology enables devices to communicate and connect with one another without or very limited human interference. And as stated before, devices will continue to be developed to connect and communicate with other devices in an automated way, sharing information and data.

Source: Global M2M Connections

6. B2B IoT market size

2015: $195 billion ⇒ 2020: $470 billion

What it means: The B2B market segment is projected to drive significant revenue and includes system integration, data services, and analytics, networks, devices, and legacy embedded systems. With the explosion of data and data sources through the B2B ecosystem, organizations will continue to base integration on technologies that deliver multi-enterprise collaboration to maintain communication among partners, customers, suppliers, data lakes, and other external networks.

Source: IOT of Industrials

7. Business investment in IoT

2015: $215 billion ⇒ 2020: $832 billion

What it means: Spending on anything IoT-related has been apparent. So, predicting a $600 billion boom over five years isn’t surprising. Everything from smart home appliances to work automation tools, investing in IoT is almost a given among business practices for companies that want to see growth and an improved bottom line.

8. IoT spending in the transportation and logistics industry

2015: $10 billion ⇒ 2020: $40 billion

What it means: Transportation and logistics companies will obviously keep taking strides in profitability, productivity, and overall operations efficiencies through technological advancement. RFID adoption, often in conjunction with traditional line-of-sight technology offers a potentially data-rich supply chain that leads to insight-based decision making. However, new data sources present new challenges when it comes to accessing, ingesting, and utilizing the data for business purposes. Currently, integration solutions hold a lot of promise for helping address the challenges of IoT. With a mix of existing legacy technology and IoT-specific applications, enterprises can leverage edge computing and data that are transported to a centralized cloud network to enable decentralized, multi-enterprise communications that are vital supply chain and logistics companies.

9. Projected IoT economic impact

Range by 2025: $3.9 trillion ⇔ $11.1 trillion

What it means: With more than $7 trillion dollars between the low and high end of these estimates, the figures highlight the scale of unknown factors in accessing the success and extent of adoption of the Internet of Things. At the high end, $11.1 trillion dollars represents around 11 percent of the world economy, underlining the massive scale of its ultimate impact. The McKinsey forecast includes influences across many global industries and regions. But IoT is benefiting from improvements to technology infrastructures and the ability to more easily connect devices. The McKinsey study adds that power requirements, costs, and the development of more integrated solutions affect projections.

Source: What's New with the Internet of Things

10. Percentage of enterprises adopting IoT

2017: 30% ⇒ 2020: 65%

What it means: This all comes down to the enterprise's ability to exploit the Internet of Things for market advantage. First of all, IT and business leaders need to consider the extent to which this type of technology can be utilized to improve ROI, market competitiveness, and brand differentiation. Secondly, as the market matures, questions around the digital security of potentially sensitive personal and corporate data will be addressed. Finally, the internal competency center required to implement and leverage devices will find that the necessary skillset becomes less rare. As a result, adoption is tied to the cost-benefit analysis of the ability to exploit this technology either as a product or as a way to improve the business.

Source: IOT eBook

Read on to find out if your business is ready for the Internet of Things revolution. The Internet of Things (IoT) has gained a tremendous head of steam over the last few years.

Benefits of the Internet of Things

1. Industrial Automation

Enterprises are using the Internet of Things as a way to increase the reliability of anything they may be doing that is automated.

This is especially true for the manufacturing industry, as an example.

Take, for instance, the smart factory. Modern automation in multiple areas of production relies on robots building things. Traditional maintenance would mean that production would be slowed or shut down for the purpose of inspection, repair, or replacement. In the realm of IoT, manufacturers gain an advantage.

They use devices that are Internet-enabled.

Now, companies have access to real-time sensory data generated from the machines doing assembly on the factory floor. Data scientists can design an algorithm to study data and help predict when a possible failure in one of these machines is likely. Predictive analytics on device-generated data allows maintenance to be proactive, minimizing the business downtime.

Monotonous tasks are automated and done by machines, allowing employees to focus on other important business processes. And while industrial automation helps provide capabilities for the company to increase production levels and efficiency, understanding and predicting the health of an object requires stable access to the data.

Through IoT connectivity, manufacturers are able to gather and potentially centralize the data from multiple devices. This starts the process whereby real-time health checks or meaningful long term analytics around that data are possible – and incredibly useful. Within the last decade, we have increased our ability to gather real-time information on what’s happening and perform timely analysis. In this way, manufacturing enterprises are able to capitalize on the “interconnectedness” that comes from the Internet of Things.

2. Data Collection

The amount of data in the world has never been larger than it is today. And looking forward, the speed of generation is increasing constantly, pointing to an even more data-rich future. But what good is all that data if we don’t have the ability to access, aggregate, analyze, and also improve the way that data is used?

The fundamental appeal of IoT is that the devices will generate unprecedented volumes of data. The wealth of information offers the potential for individuals and businesses to make better, more informed decisions. However, the data has to be retrievable.

One challenge with the IoT is how to get the data being generated off the device to a place where it can be meaningfully analyzed. For consumers, a lot of these questions are answered by the accompanying applications that pair with wearable heart rate monitors and smart appliances. Businesses are still addressing the challenge around how to get the data. And this doesn’t begin to address the security questions of IoT, but more on that later.

3. Customer Experience

IoT allows for more personalization than ever before. Because all these devices are connected, customers expect a certain level of customer support that is ingrained within the device itself. Services can be adjusted on the fly, and refined based on what a customer is asking for at that particular moment, whatever it might be. Devices are also able to improve over time as they gain more data and can make more accurate decisions tailored to each customers’ needs.

4. Increased Revenue

Internet of Things can drastically reduce overhead and lower a business’ expenses. At the same time, IoT will increase efficiency by allowing an enterprise to take advantage of a new business function. For instance, organizations can benefit from knowing exactly how much they need and when in terms of inventory. IoT devices can be used to track 7-eleven Slurpee® machines or McDonald’s beverage stations. IoT provides better inventory management, which means fresher food gets delivered, and the food is easier to track.

What are Two Major Concerns Regarding IoT Devices?

As much as we have laid out how useful the Internet of Things can be, there is also a flip side, and it’s one that enterprises must be cognizant of.

1. IoT Security

Like any other emerging technology, IoT brings an entirely new set of challenges to an enterprise. For those companies prepared to integrate some form of IoT into their organization, there remains a level of confusion around IoT standards, policy, and governance. While IoT shows promise due to the number of devices that are connected, that’s also a potential detriment to the viability of its security. The more devices there are, the more likely there will be a security breach. The sheer volume of devices is alarming.

What is secure today, might not necessarily be secure tomorrow. And that’s a major concern in terms of IoT devices. Imagine hackers being able to access (or even control) a smart car, your wireless router, potentially turn off a heart monitor, or change the rhythm of a pacemaker, as scary as that sounds. A more connected world means one security glitch is all it could take to impact personal data privacy or bring down an enterprise’s security and hold the business hostage.

2. Standards (or lack thereof)

As IoT devices have grown, many have called for uniform standards, in order to hold companies accountable and eliminate unsecured devices, and with it the security threat that they pose. Manufacturers and providers will have to increase their liability in order to fully make IoT secure. Companies must align efforts with each other around policies such as information sharing.

Internet of Things Companies

Many major vendors have taken advantage of the potential of IoT by creating hardware and software and offering the services that stand to reshape multiple facets of businesses that embark on an IoT initiative. Other early adopters and innovative companies have incubated IoT projects or created platforms that are now in full swing and driving significant market interest:

- Amazon’s AWS IoT platform

- Features smart warehouses, core interconnection layer, and sync via AWS Greengrass, the AWS IoT platform started in 2015 that allows consumers to quickly place an order.

- AT&T IoT Platform

- With APIs and device connectivity, the AT&T platform helps developers build, deploy, and scale IoT solutions.

- GE Digital

- Concentrating on next-generation industrial processes, GE is one of the first companies to form a digital ecosystem around IoT with over 700 interconnected companies.

- Google Cloud IoT

- Google’s Cloud Core IoT offering is a managed service to connect devices via protocols such as MQTT and HTTP.

- IBM Watson

- IBM is focusing on artificial intelligence or A.I. as a way to make sense of all the data IoT generates in a number of industries such as automotive where there are potential applications for driverless vehicles. IBM is facing steep competition from Google and Amazon in the so-called A.I. War.

- Microsoft Azure IoT Hub

- Microsoft Azure is a cloud platform that supports data storage for IoT-generated data and is a popular choice of the cloud for the infrastructure that sits between the devices and analytics applications.

- Qualcomm

- Qualcomm produces processors and 4G LTE and 5G modems that can be used in mobile and IoT devices.

The Future of IoT

The future of this cutting-edge technology within the enterprise is going to be very interesting, to say the least. Intelligent companies that explore IoT may realize the significant business advantage. For instance, a third-party logistics outfit can use IoT plus new streams of data and analytics to optimize routes driving down the cost of doing business and increasing operating margins.

However, like any nascent technology, the risks are inherent. The issue will start to evolve from the need to address the challenges outlined above, from what do these things look like, and where are they located, to how can the individual or the organization get the information to an application or a system that’s meaningful?

Through connection, integration, and maintenance, how businesses choose to create worthwhile interactions with their data will determine whether the Internet of Things is successful or not.

For the majority of organizations, IoT remains unknown territory. And going forward, companies must be able to manage these devices and all the data in a responsible, well-governed way in order to minimize risk and fully capitalize on the true potential.

Why IoT Requires Integration

What good is IoT adoption if you can’t tap the vast amount of data being generated for potential insight?

Oil companies around the world were asking themselves that same exact question. In 2015, a report by McKinsey & Company found that more than 99 percent of data from 30,000 oil rig sensors, which tracked drilling, production, and rig maintenance, somehow wasn’t reaching operational and industry, decision-makers.

If you flip that number, less than 1 percent of the data generated on the smart oil field was being used, resulting in lost production insight and, ultimately, lost revenue. That’s certainly a stark figure, and one that underscores the hazard of IoT that’s missing solutions for data access, aggregation, and ingestion, highlighting the need for digital transformation and integration infrastructures as a foundation to fully support IoT devices. And it further emphasizes the need to gather, store, and analyze data that will provide perspective and assist operational improvement over time.

As innovative and disruptive as IoT has become on a global scale, there’s more to it. The truth of the matter is that for businesses to take advantage of IoT, they must create and invest in an underlying IT infrastructure required to securely and reliably handle the data. And there’s value to doing so. According to the industry analyst firm, Forrester, a 10-percent bump in accessing data can result in an ROI increase of $65 million net income for a large-scale company.

When it comes to IoT, what makes the technology important isn’t necessarily the actual device. It all comes down to the data that these devices generate. For organizations to properly take advantage of that data, IT personnel and business influencers must be able to access, analyze, and implement the insight that data has to offer. And that requires a blend of traditional and modern integration technology and infrastructure.

Every successful company needs a scalable infrastructure that can support any-to-any hybrid integration, data transformation, fast and secure file transfer, and end-to-end visibility of all the data that flows through their dynamic ecosystems.

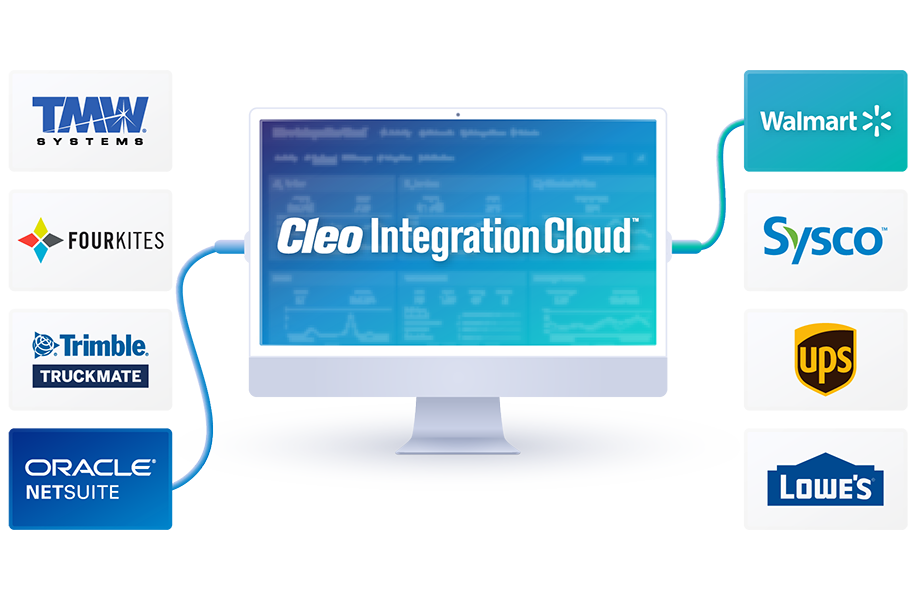

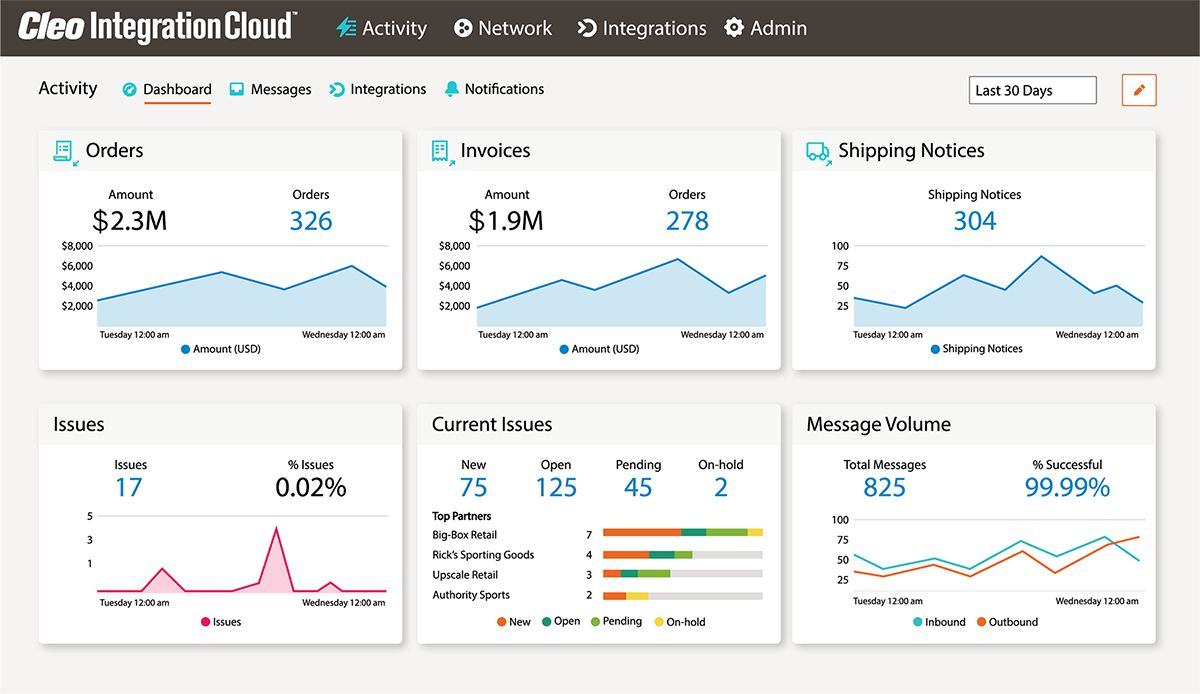

Cleo Integration Cloud enables enterprises to accelerate ground-to-cloud and cloud-to-cloud integration processes to easily integrate IoT devices, applications, and storage and business platforms. With Cleo, you can connect all your data, no matter what it is, and wherever you want it, be it on-premises or in the cloud.

About Cleo

Instantly access demo videos

Comprehensive Guide to Gaining B2B Control

Duraflame Case Study