Top 5 Corporate Compliance Mandates You Must Meet

Compliance regulations govern various industries and often require enterprises to proactively fend off risk and ensure business associates are acting in a secure, responsible manner. Corporate compliance may be especially daunting for some because companies literally must devise (and adhere to) security standards comprehensive enough to meet every single regulation applicable to their business.

It’s a tough ask and often means lots of red tape, but such regulations keep communications processes in today’s hyper-digital business landscape from devolving into something akin to the Wild West. Here are a few of the common corporate compliance mandates organizations face today:

GDPR – General Data Protection Regulation (2018)

The GDPR went into effect in May of this year, which standardizes data protection law across all European countries while extending strict rules on controlling and processing personally identifiable information. GDPR compliance is intimidating, but it also can be simplified through a core secure data movement platform in place. A robust managed file transfer (MFT) and integration platform with a reliable vendor can ensure that routine business-critical information flows are not risking expensive non-compliance penalties.

To ensure the secure collection, movement, and use of personally identifiable data, many organizations turn to MFT and business integration solutions, which leverage encryption, non-repudiation, data integrity checks, comprehensive transfer logging, and integration with existing security systems to securely transport personal data to and from companies.

HIPAA – Health Insurance Portability and Accountability Act (1996)

President Bill Clinton signed into law the HIPAA legislation to safeguard personal health information physically, electronically, and across the networks, including the transmission of such information into cloud environments. This means hospitals, clinics, labs, and all other business associates must maintain the utmost care with medical records, especially regarding file transfers. In fact, the HITECH Act – Health Information Technology for Economic and Clinical Health Act – of 2009 passed in response to the increased use, storage and transmittal of electronic health information.

To ensure patient privacy and to protect personal data, organizations require the ability to track, report, log, and govern sensitive medical, pharmaceutical, financial, and patient data stay in compliance and meet audit criteria.

PCI DSS – Payment Card Industry Data Security Standards (Early 2000s)

The Payment Card Industry Data Security Standard (PCI DSS) is the security standard that companies must meet if they are to process cardholder data, which is a key concern for retailers and e-commerce organizations. There are 12 requirements to PCI DSS, but often the most difficult one to keep compliant with is Requirement 3: Protect stored cardholder data. PCI DSS is increasingly important for companies offering online pay options on hosted platforms. Major cloud providers, including Google Cloud Platform, Amazon Web Services, and Microsoft Azure, made significant investments over the years in certifying for PCI DSS.

Organizations that must certify for PCI DSS require a secure network to facilitate transactions, encryption for cardholder data in transit and at rest, and advanced auditability capabilities to maintain compliance.

SOX – Sarbanes-Oxley Act (2002)

Sarbanes-Oxley was enacted in reaction to a number of major corporate accounting scandals (remember Enron, anyone?). The legislation set out to improve corporate governance and accountability, and all public companies must now be SOX compliant. This affects business across industries (including SaaS logistics companies) SOX mandates not only affect the financial arms of a company but also their IT departments, which are charged with securely storing any and all of the associated records.

Organizations must ensure end-to-end security of data in motion and at rest, trackable and guaranteed delivery, non-repudiation, and numerous operational SLAs and regulatory requirements to help meet an important regulatory mandate like SOX.

FIPS 140-2 – Federal Information Processing Standard (2001)

FIPS 140-2 certification is critical to any vendor selling into government and other heavily regulated industries because its standards prohibit agencies from using unapproved cryptography on sensitive data within the federal government. FIPS 140-2 certification evaluates products against 11 areas related to the structure and implementation of a solution’s cryptographic design to ensure it protects the information it’s supposed to be protecting. The healthcare, banking and financial services communities also are increasingly adopting FIPS 140-2 because of its rigid standards.

Although FIPS 140-2 is a federal standard in the U.S. and Canada, it’s a security benchmark that has been widely adopted around the world in both government and non-government segments.

***

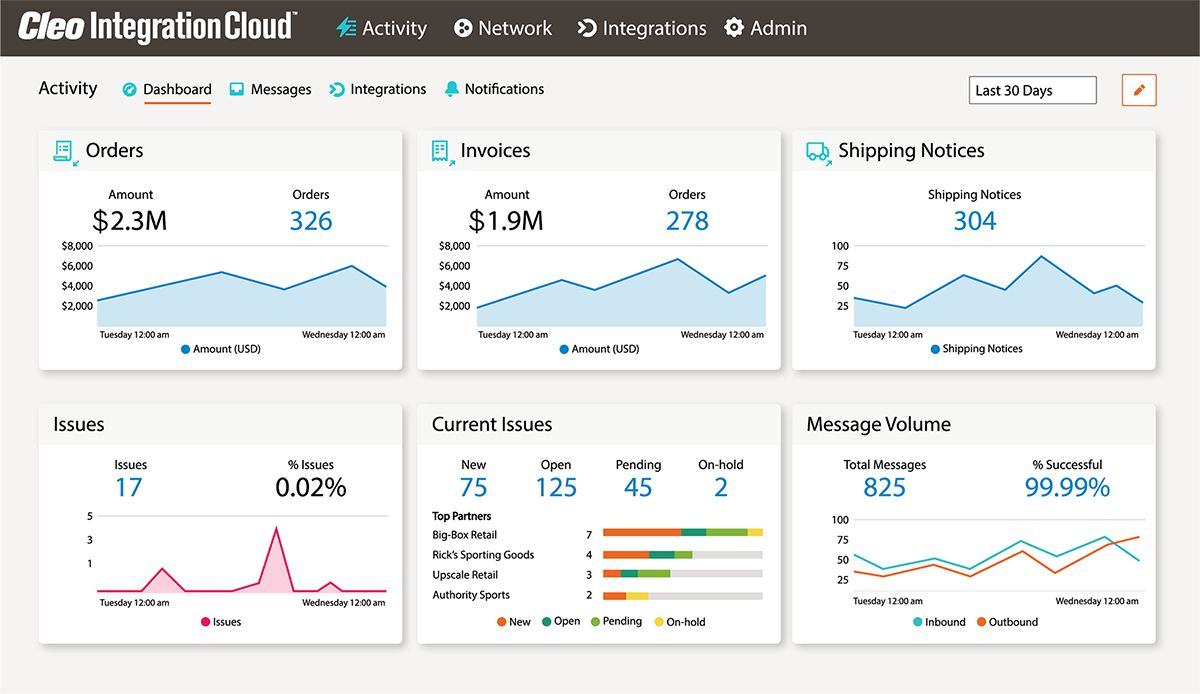

Anything less than 100 percent compliance can lead to heavy fines and loss of credibility for a business, and it’s important to stay in compliance to build trust with your customers and trading partner ecosystem. Do you have industry and customer mandates that you need to meet? Cleo Integration Cloud solutions arm companies across industries with the tools required to secure, control, and manage their data flows and achieve increasingly complex corporate compliance mandates.

About Cleo