How an API-First Integration Strategy Creates Value in Logistics Ecosystems

Cleo has more than 1000 customers in the logistics arena. In this new blog series, we’ll focus on how logistics companies are embracing integration technology to evolve their ecosystems, despite the challenges of the COVID-19 crisis. These logistics organizations are winning because they are embracing the use of not simply APIs or EDI, but a combination of the two, on one integrated platform.

Introduction

The logistics sector has become an extremely hot, yet volatile sector in today’s transformative digital economy.

Layer on the supply chain disruption wrought by COVID-19, and you discover that significant growth opportunities are opening up for savvy logistics players to capitalize; at the same time, digital fault lines are appearing that can derail traditional players in the logistics space if they’re not future-focused on enhancing their ecosystems.

In short, there will be winners and there will be losers.

The post-COVID global business environment will force companies to change how they operate.

So, companies must take steps now to plan ahead, and imagine what that future will look like.

How will that future evolve?

Sizing up the “new normal” calls for a frank discussion about technology – especially integration technology.

As we saw in my first CEO blog series (“Real Stories of Supply Chain Agility”), advanced integration technology is critical for supply chain agility.

However, to get such agility, companies first need to get clarity around what they need their business processes to do.

After that, they can lay in the APIs or other fundamental technologies to execute on whatever kind of processes your business needs.

It is imperative for companies to utilize modern integration technology to overcome any potential supply chain disruptions that may come their way.

And the best way to start is to understand the lay of the land, and then discuss what an API-first strategy can do for you.

Logistics Supply Chain Management is Incredibly Complex

The logistics supply chain has become incredibly complex. But why?

Reasons range from shifts in global manufacturing to rising consumer-driven demand, to increased volatility in business-driven demand, all further complicated by supply chain disruptions such as hurricanes, international tariffs, and now the global COVID-19 pandemic.

So yes, it’s dynamic. However, it’s also lucrative.

Shipping costs range from 4% to 6% of revenue for the electronics and automotive industries, and as high as 8% for manufacturing companies.

Thus, it’s not surprising that the number of service providers in the logistics space has mushroomed in recent years as competition to garner a share of the available profits intensifies.

There are also multiple modes of shipping, as well as many different load types.

Additionally, there are multiple defined and specialty services that even the average logistics company must stay on top of. Here’s a simplified breakout:

- Multiple Modes: Road, Rail, Ocean, and Air

- Multiple Load Types: Truck Load (TL), Less Than Truck Load (LTL), Dedicated

- Multiple Service Types: Dedicated Contract Carriage (DCC): Domestic Transportation Management, International Transportation Management, and Warehousing & Distribution

- Multiple Ancillary Services: Customs clearance, purchasing insurance, unloading cargo from the vessel, etc.

If you take just a moment to consider the digital complexity underneath all that, you begin to see the critical role ecosystem integration solutions can play for the logistics providers who want not only to survive but expand their category footprint.

To truly grasp why an API-first strategy is a key to mastering today’s digital complexity, we first need to explore:

- Why the sector is transforming

- The role of third-party logistics providers (3PLs), and 3) what key functions logistics businesses are currently focused on.

Rapid (Digital!) Transformation in the Logistics Sector

The globalization of supply chains and the growth of technology and software has caused massive disruption in the logistics sector. We observe three major macro trends:

- Shippers are increasingly desiring control, visibility, and cost reduction.

- Carriers are wanting to build direct relationships with shippers by providing complete transportation solutions rather than chasing the freight business. Yet, they want to ensure that their 3PL and freight brokerage customers do not view them as direct competitors and thus continue to benefit from indirect channel demand from such players.

- 3PLs and freight brokerages are being dis-intermediated by technology-driven digital freight brokerages such as Amazon Brokerage, Uber Freight, Convoy, and uShip.

There is fierce rivalry in the logistics sector. Customers are turning into competitors. Heavily funded technology-driven startups are appearing.

Larger players are gaining even greater stature by building new end-to-end solution-based business models through partnerships and acquisitions of other players in the space.

And newer competitors are aggressively eating into traditional logistics companies’ revenue streams.

Given all this activity, the “integrators” are taking an increasing slice of the market by providing end-to-end services and even many carriers themselves are digitalizing their services and their operations.

With the rapid embrace of digital transformation in supply chains, traditional logistics businesses (i.e., those who’ve historically relied on human resources for manually managing freight) are increasingly challenged.

They were already plagued by inefficiencies in asset utilization, over-reliance on manual processes, and slow response times to customers; and all these existing weaknesses are compounded by the sudden arrival of digital startups and digitally savvy competitors.

Except for the largest players (who are themselves digitally transforming), the rest of the logistics space -- especially freight brokerages -- is rapidly being disintermediated.

The more progressive firms, seeing the writing on the wall, are proactively abandoning their manual processes and embracing digital technology and integration software to realign themselves to survive and thrive.

The Rise of 3PLs

Today, the U.S. logistics industry pulls in about $1 trillion annually and is set to grow to $1.4 trillion by 2024.

The business niche of matching freight between shippers wanting to transport goods and carriers with capacity and expertise to fulfill a freight movement request is age-old.

But in modern times, as supply chains have become increasingly complex (thanks to the globalization of manufacturing and distribution), this common exchange has led to the rise of freight brokers (sophisticated third-party logistics or 3PL providers) who serve the critical logistics needs of shippers looking to outsource such services.

Freight brokerage alone is a $72 billion sub-industry of the U.S. logistics market.

In this segment, there is massive disintermediation occurring, largely due to the emergence of technology-driven “digital first” startups and other newer competitors like Uber Freight.

Currently, there are 17,000 registered brokers in the U.S., with the top 50 3PLs commanding only 15% market share led by C.H. Robinson ($17 billion) at the top and number 50 player, Nippon (USA) with $800M, at the lower end.

This shows the market is extremely fragmented with scores of smaller players who are struggling to keep up with the pace of change.

Their inability to always do so is leading to consolidation as well as disintermediation by savvy digital players.

All this disruption is what’s driving the need for more robust ecosystem integration solutions. But what, exactly, is it these companies need?

What are the Various Logistics Players Focused On?

To exploit the opportunities in the logistics sector, we see a reorientation among the various groups of players in the sector:

Shippers

The primary focus of shippers is to gain control, visibility, supply chain flexibility, and cost reduction.

To achieve these goals, they’re pursuing:

- End-to-end visibility across shipping lanes and locations

- Predictive analytics on routes and delivery times

- Supply chain flexibility with alternate sourcing

- Carrier and 3PL performance scorecard compliance to improve customer satisfaction

- Reduced cost, increased governance and control

From a technology perspective, shippers are focused on API-enabled TMS, streamlined EDI processes, and API integration to extend EDI capabilities (such as Load status, location status, carrier rating, and delivery tracking messages)

Carriers

The primary objective of carriers is to win more demand at the right prices to maximize revenue. Their key areas of focus include:

- Compliance with the ELD mandate for Hours of Service (HOS) requirements

- Building deep relationships with 3PLs and Shippers

- Delivering end-to-end visibility and compliance with SLA scorecards

From a technology perspective, ELD compliance is critical given the “final rule” date of December 16, 2019.

Further, partnership with new “visibility platforms” like project 44 and FourKites are critical to comply with shipper’s visibility requirements.

Also, API- and EDI-based integration with shippers and 3PLs are foundational for conducting business.

Increasingly many 3PLs and tech-savvy shippers are requiring APIs to compliment EDI with real-time messages for carrier rating, location status, and expectations.

The Case for API-First Digital Ecosystem Integration for Logistics

Given the foregoing, you can see why there is an urgent need for logistics companies to become digital.

Their survival depends upon having a digital platform first and foremost to enable the appropriate process automation for delivering an enhanced customer experience.

That experience needs to guarantee real-time end-to-end visibility through a digital front end, advanced analytics, and an intuitive way of managing it (through a cockpit or control tower view) to boost operational visibility and connectivity between previously siloed supply chain partners.

Companies articulate their needs through technology.

For instance, when they want to be more responsive to their customers, they talk about CRM.

When they want to better manage the processes around inventory, they talk about ERP. Today when they want agility or real-time interactions, they talk about APIs.

What’s important to understand is that each of these are just technologies coupled with implementations.

What's more important is the overarching process that is executed using a variety of these different technologies.

Process in mind, the key enablers of a digital ecosystem enablement platform are its ability to:

- Consolidate all API-and EDI-based integration

- Accelerate shipper, carrier, logistics provider, and application onboarding with pre-built templates, connectors, and pre-defined profiles

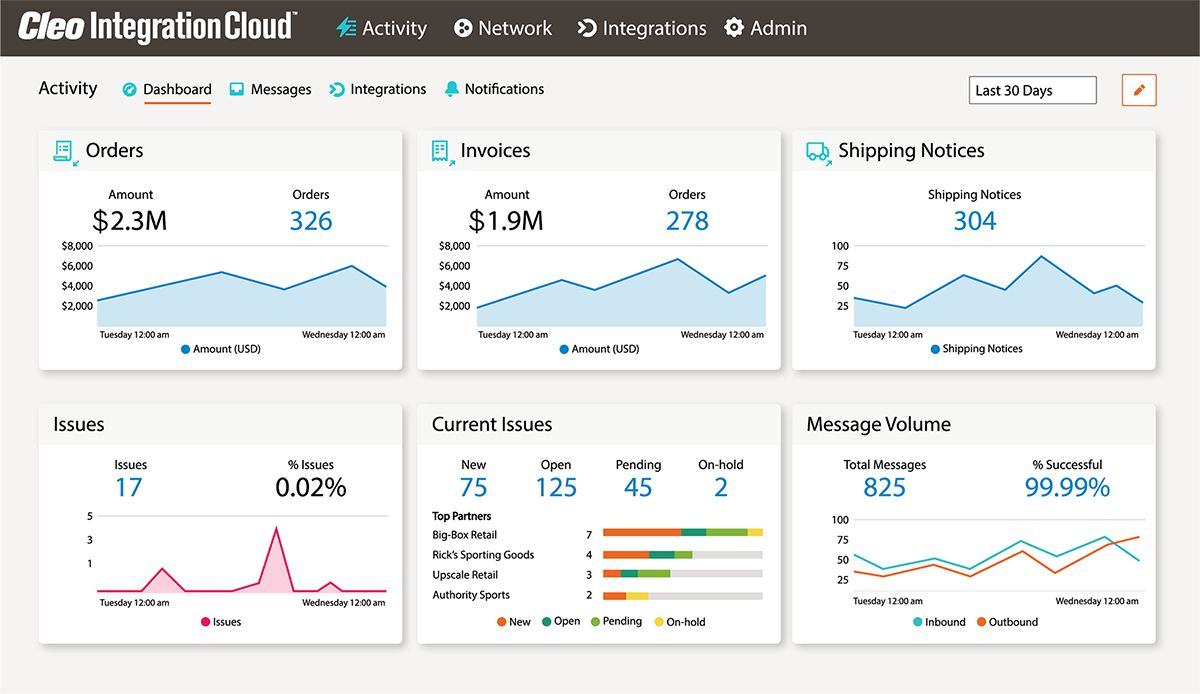

- Provide real-time integration dashboards to surface operational visibility and insight to enable SLA and scorecard compliance

- Identify and act on ecosystem trends, enable new digital revenue streams, and drive digital transformation initiatives

A process such as order-to-cash may involve real-time inventory lookups, transactional purchase orders, acknowledgments and advanced shipping notices, status updates, and finally transactional settlements via proprietary standards and systems.

Creating, transmitting, and accepting a purchase order can be instantaneous and leverage the real-time interactions of a well-designed API.

Conclusion

We are at a unique time in supply chain management for logistics.

With an API-first strategy, logistics companies have the opportunity to change the foundational processes which run their business, improve how they operate and execute, and enhance business outcomes.

While EDI is still highly prevalent and will be heavily operational for years into the future, the rapid growth of APIs with the ability to blend API and EDI based integration on the same platform can enable logistics companies to seize competitive advantage.

Future blogs in this series will explore the key API integration use cases for the various logistics segments and discuss how they can enable your ecosystem for the sustainable future.

About Cleo

Watch a Demo

Comprehensive Guide to Gaining B2B Control

Duraflame Case Study