Blog: The Amazon Effect: How Amazon Supply Chain Technology Broke Retail

The term “retail apocalypse” may sound a bit dramatic, but there’s no denying the competitive struggles traditional retailers are facing in today’s post-digital era. According to a report from Coresight Research, an average of 6,000 U.S. stores have closed in the past three years.

The fact is, increasing competition from Amazon continues to challenge traditional brick-and-mortar retailers, and the ripple effect of eCommerce and omnichannel retail strategies is crippling brands that aren’t prepared. But given the Sears bankruptcy filing and the longtime retail staple’s fall from grace, even the strong aren’t always surviving.

Here is everything you need to know about the Amazon Effect:

- How Amazon Has Changed the Way We Shop

- What is the Amazon Effect?

- The Amazon Prime Effect by the Numbers

- How Amazon Changed eCommerce

- The Other Side of the Amazon Effect

- Walmart vs Amazon – a quick history

- Omni-Channel Retail and the Digital Supply Chain

- How Amazon Continues to Adapt

- How to Be Like Amazon

How Amazon Has Changed the Way We Shop

Amazon's impact on the retail industry affected how consumers consume and how businesses serve their clients, it’s no wonder the “Amazon effect” has become a phenomenon business school will analyze for years to come.

Everywhere you look, the behemoth is around. One of your friends probably just used Amazon to buy a new book. Maybe your significant other researched and eventually purchased new sneakers. Perhaps you’ve downloaded a movie or TV show on your phone, tablet, or laptop for a long airplane ride.

But as much as the simplicity of Amazon has changed the game for consumers, it’s drastically changed the retail and eCommerce landscapes and shifted what it means to have a modern, agile supply chain.

What is the Amazon Effect?

The Amazon effect is the disruption of brick and mortar stores in the retail market, caused by a dramatic increase in online sales.

It has its own name because of how Amazon changed eCommerce to transform the customer experience and the omnichannel business model, as well as the downstream effects it’s had on a variety of market segments.

Online shopping enables a fast and efficient shopping experience at affordable rates. With just a few button clicks, a consumer can purchase via an eCommerce site and expect that item to be delivered in a matter of days, if not hours.

The Amazon Prime Effect by the Numbers

Amazon's impact on the economy can be summarized by the following statistics:

- According to emarketer.com, US consumers will spend $709.78 billion on eCommerce in 2020, representing an increase of 18.0%. Brick-and-mortar retail spending is expected to decrease by 14.0% to $4.184 trillion.

Online sales will account for 21% of total retail sales, up from 16% in 2019 and 14% in 2018.

Retail chains will end the year with a collective 76% growth in eCommerce.

Amazon sales represent nearly a third—32%—of all U.S. eCommerce sales growth in 2020

A few of the notable traditional retail store closures and layoffs include:

Discount shoe retailer Payless filed for bankruptcy in February 2019 and announced it was shuttering all 2,500 of its North American stores.

Dollar Tree plans to close nearly 400 stores under the Family Dollar brand and convert 200 more into Dollar Tree stores.

Women’s clothing retailer Charlotte Russe filed for Chapter 11 bankruptcy protection and announced it would liquidate a total of 520 stores.

- Pharmacy discount chain Fred’s announced it would close more than 150 underperforming stores by May, which is nearly a third of its total brick-and-mortar presence across 13 U.S. states.

JCPenney, Abercrombie & Fitch, and Victoria’s Secret also have announced significant store closures this year as they evaluate ways to stay relevant amid disruptive technological change. Retailers hoping to avoid participating in the retail apocalypse must shift their focus to giving customers new ways to interact with the brand, building a strong, integrated supply chain, and leveraging data to create value-added services.

How Amazon Changed eCommerce

Because of Amazon, consumers not only demand but now expect their online shopping experience to feature all of these things at once:

- Competitive pricing

- Highly available inventory

- Lightning-fast fulfillment (and the ability to change orders)

- Real-time tracking information

- Mobile support

- An easy return process

Rather than mostly brick-and-mortar experiences, customers are now accustomed to a dependable online and mobile experience. The idea of Amazon even getting an order wrong is almost shocking; anything less than 100 percent accuracy for customers is almost laughable, and we have the Amazon supply chain to thank for that.

Additionally, for its loyal customers, Amazon features additional membership levels, each with its own benefits. Amazon Prime has free two-day shipping, access to a video streaming service, and other perks. Prime Now is only available in certain areas to Prime members but offers a two-hour (!) shipping option in an effort to further blow our collective minds.

It’s nearly impossible to beat Amazon as a retailer on pricing, selection, and service, so the question becomes, how do companies adapt to the Amazon effect on retail – and its game-changing disruption inevitably threatening other segments – and position themselves to take advantage?

As Amazon has proven, the name of the game is service. The ability to find anything at any time and have it in your hands in a couple of days is now possible. In order to adapt, companies must utilize modern technology designed to run in real-time that enables your company to provide customers the services that they now expect. If anything, the really amazing thing Amazon does is it reinforces the importance of a frictionless customer experience.

The Other Side of the Amazon Effect

As Amazon and the supply chain become synonymous, and the company continues its push to gain an even larger footprint into the world of physical retail, one of, if not its biggest competitor, recently made an acquisition that will have ripple effects for years to come.

Walmart buys Flipkart

In 2018, Walmart acquired a majority stake in Flipkart for a reported $16 billion, adding another eCommerce company to its arsenal. The big-dollar purchase of a 77 percent stake in Flipkart maybe by far Walmart’s biggest acquisition ever.

The Flipkart acquisition marks the third year in a row, Walmart has pursued significant acquisitions as the standard-bearer of its eCommerce strategy. With the two other significant acquisitions – Jet.com for USD $3.3 billion in 2016 and Bonobos for USD $310 million in 2017 – a pattern starts to emerge.

By purchasing Flipkart, Walmart continues to grow its eCommerce portfolio and expand its digital reach with the aim to capture the boom of online shopping globally.

According to an Indian business survey by Morgan Stanley AlphaWise, Internet access in India will double in the next 10 years, and roughly 915 million of its citizens will be on the Internet by 2026. Another nugget from this report is that India has among the highest number of young people entering the workforce over the next two decades. Both of these trends are leading indicators that suggest Walmart just bought a massive potential customer base for online retail shopping.

The flipside is a willingness to accept the risk of short-term negative impact to its stock price; a price Walmart seems willing to pay in order to reap what the megalithic brick-and-mortar retailer sees as the inherent competitive benefits of investing more in eCommerce long into the future.

5 fast facts about Flipkart:

- Flipkart is one of the largest and best-known eCommerce companies in Asia with a 45 percent market share of India’s online retail shopping sector

- In April 2017 Flipkart had a USD $11.6 Billion valuation

- Both of Flipkart’s founders are former Amazon employees who left to establish their own competitive book-selling startup

- In 2009, the company began using the combined personal savings of its two founders totaling approximately USD $6000.

- Flipkart is India’s most visited website and ranks as the 118th most visited website globally.

Walmart has made it very clear how much it wants to continue to grow its digital business. And the importance of Walmart banking on major eCommerce acquisitions in order to gain an even larger digital presence is interesting for a couple of reasons. But first, some background:

Walmart vs Amazon – a quick history

Walmart grew to become the most successful traditional retailer in history. Its immense success came from a counter-intuitive strategy around where it chose to locate stores.

Rather than pursuing highly-sought-after, expensive, and competitive urban spaces – where large populations of consumers lived and shopped, Walmart focused on opening large footprint stores outside of dense population areas.

They decided on large footprint stores where the people and the competition weren’t – in or near small towns. The strategy worked and not only allowed Walmart to monopolize large swaths of rural America, but it also created a new type of big box store – one place that carried everything, providing one destination for all shopping needs.

Amazon followed a slightly different approach when it opened its “store” digitally. However, it benefitted from similar conditions. Like Walmart tapping into a low-competition market, Amazon was at the forefront of online retail and was thus able to capitalize on the “there first” factor and through diversification, grow to the company it is today – a website providing one destination for all shopping needs.

Now let’s get to the reasons why the Flipkart purchase seems like a good move, starting with number 1:

Omni-Channel Retail and the Digital Supply Chain

The current disruption across the retail industry shows the ramification the Amazon effect is having. On one hand, it is driving companies like Walmart to evolve into eCommerce participants, and on the other digitally native companies are walking backward into physical stores.

The predicate is any organization that evolves and participates in online and brick-and-mortar will therefore be able to survive. But this is extremely flawed.

So, what is the Walmart/Amazon difference?

Why, as a brick-and-mortar retailer, has Walmart seen such success while a litany of high-profile failures from RadioShack to Sears, to Toys R Us, been making headlines?

How has Amazon so far seen a great deal of success in investing in physical retail, an industry that for many companies is seeming going the way of the dinosaurs?

The recipe for success and one that is observable in both the Walmart and Amazon models is an omnichannel approach to customer engagement.

Here’s a quick definition: Omni-channel is a truly modern approach to retail in that it aims to provide a seamless shopping experience to the consumer across every touchpoint or channel, including digital stores, mobile devices, and physical locations.

According to the National Retail Federation, other important customer expectation considerations in an omnichannel experience are cost and convenience factors such as:

- Free shipping

- Flexible in-store pick-up and return

- Accurate inventory across channels

In a nutshell, omnichannel adds a high degree of supply chain complexity to a modern retail environment that many companies have had a hard time dealing with.

To deal with the complexity of an omnichannel retail presence necessitates a world-class supply chain. Both subjects of this blog are indicative of the most robust and efficient retail supply chains on earth. Here are two metrics to provide a measure of perspective:

- 90 percent of the American population lives within fifteen miles of a Walmart store – BusinessPundit

- Amazon operates 20 distribution centers within 95 percent of all US metropolitan statistical areas – McKinsey, US Census

Walmart has automated pick-up centers, which makes it easier to shop online at Walmart.com than ever before. Another modern approach Walmart has taken came after its purchase last year of Parcel, a company that specializes in last-minute delivery services. This aims to cut shipping times and delivery costs for customers by also incentivizing its employees to make the deliveries and gain some extra income after their shifts.

World-class supply chains have world-class digital underpinnings. While Amazon – a tech company – gets a lot of recognition for this trait, Walmart is often given short shrift given where they stand today.

Previously, Walmart’s online business was a completely separate entity from its physical stores, but has now fully integrated both components with a digital data mesh for fully- unified and accurate inventory management across the multichannel supply chain optimized for the omnichannel customer experience.

In essence, Walmart’s strategy of digital growth through acquisition is continually dependent on the quality of its underlying digital infrastructure. It is the technological backbone of Walmart that truly makes it a viable competitor against one of the most dominant and disruptive entities on the planet – Amazon. And it is also the greatest weapon Walmart has against the Amazon effect.

How Amazon Continues to Adapt

While brick-and-mortar retailers are attempting to reverse the trend of losing market share to the quick-growing eCommerce crowd, Amazon is interestingly facing the unique challenge of trying to open the door and successfully establish a niche in the physical shopping realm. In order to be competitive in the offline world, Amazon needs to face off with Walmart and a select number of other traditional retailers that have bridged the digital gap while remaining dominant players.

This is the other side of the coin to what is commonly referred to as the Amazon effect. While Walmart has taken the fight to Amazon from a digital perspective through acquisition, Amazon is doing the same by establishing its presence in physical stores with flashy buyouts of well-known retailers as evidenced by its $13.7 billion purchase of Whole Foods.

How to Be Like Amazon

Companies must operationalize technology infrastructures to integrate eCommerce applications, back-end systems, and other supply chain solutions to support a variety of data-driven business processes with third-party logistics organizations, suppliers, distributors, retailers, and a host of other trading partners. Aligning these parties begins a modern approach to support the fast delivery of goods and services, and it’s crucial to be able to minimize the time it takes for a customer to receive his or her goods, but also to offer a personal touch.

An integrated supply chain that’s responsive and reliable will continue to be the fundamental difference that separates businesses from the competition, and without an effective supply chain integration strategy in place, the idea of competing in today’s Amazon-effected world is a broken pipe dream.

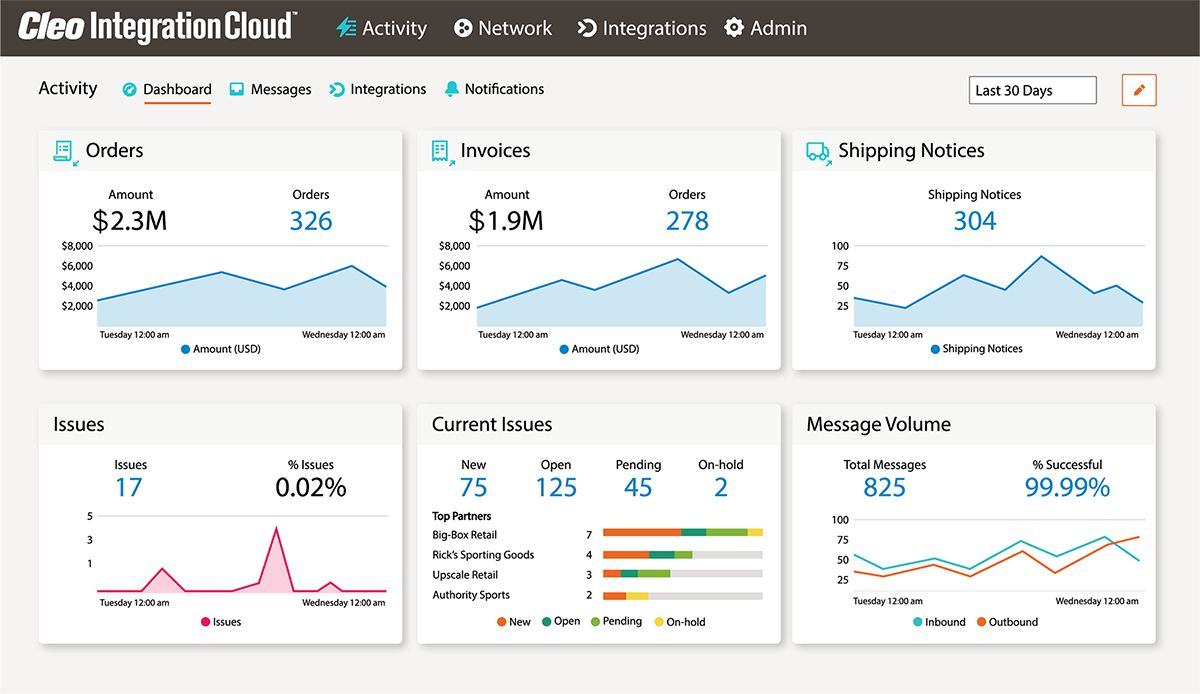

Organizations today require a comprehensive technology solution that enables multi-enterprise, application, and data lake integration to improve service levels and enhance the customer experience into a predictable, repeatable process.

- Multi-enterprise integration provides the ability to rapidly integrate with new customers and onboard trading partners, provide audit trails, automate data mapping, and make better analytical decisions via increased visibility throughout your entire supply chain.

- Application integration eliminates manually intensive file transfer processes, enables modernization and a way to migrate off legacy systems, and ends process disruptions via comprehensive monitoring features.

- EDI software integration enables businesses to secure and encrypt EDI and non-EDI file transfers

Learn how advanced integration solutions deliver the cutting-edge amazon supply chain technology that enables companies to not only limit the Amazon effect on their businesses but embrace the brave, new world it’s brought forth. It’s time to become a fully-optimized organization that’s prepared to deliver the thing that matters most – a seamless interaction delivering an enhanced, predictable customer experience.

About Cleo

Watch a Demo

Comprehensive Guide to Gaining B2B Control

Duraflame Case Study